In the ever-evolving world of collector cars, few voices carry the weight of experience and insight like David Neyens. Known for his meticulous catalog writing and deep auction expertise, Neyens has now launched Motorcopia.com – a data-driven platform designed to bring clarity and confidence to car collectors and investors navigating the marketplace.

We recently sat down with David on the Break/Fix podcast, alongside returning co-hosts Don Weberg (Garage Style Magazine) and William Ross (Exotic Car Marketplace), to explore how Motorcopia is redefining how we understand collector car value.

Tune in everywhere you stream, download or listen!

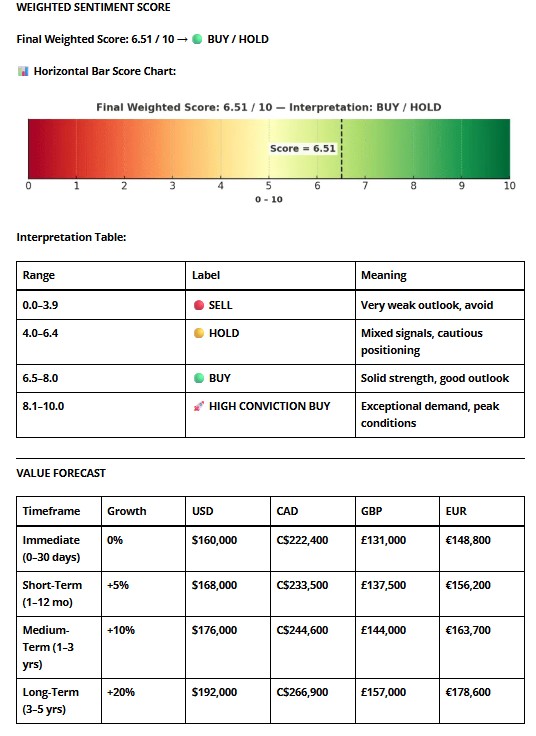

Think of Motorcopia as a Bloomberg Terminal for the collector car world. It’s not an auction site or a photo gallery – it’s an intelligence platform built for decision-makers. Whether you’re a high-net-worth investor, a seasoned collector, or a professional advisor, Motorcopia offers:

- Buy/Sell/Hold signals for specific models

- Forecasting across short-, medium-, and long-term horizons

- Deep dives into market liquidity, cultural relevance, and ownership costs

- A concise, easy-to-navigate interface that avoids data overload

As William Ross put it: “It’s very straightforward… especially if it’s your car and you want to know where it’s sitting in the market right now.”

Spotlight

David Neyens - Founder for Motorcopia.com

Motorcopia is an independent collector-car market intelligence and publishing platform founded by David C.R. Neyens, a veteran writer, researcher, and auction-catalogue specialist with a long-standing presence in the industry since 2008. Known for his deep expertise in classic and exotic automobiles, David has long been a trusted voice in auction catalogues and in the pages of enthusiast publications. Now, he’s bringing that wealth of knowledge to the digital age with Motorcopia.com, a unique platform dedicated to the intelligence and insights of the global collector car market.

Contact: David Neyens at admin@motorcopia.com | N/A | Visit Online!![]()

Synopsis

In this episode of Break/Fix podcast, the hosts explore the captivating world of collector cars and automotive journalism with special guest David Neyens. Known for his expertise in classic and exotic automobiles, David shares his journey from a career in financial services to becoming a trusted voice in auction catalogs. He introduces Motorcopia, a unique platform offering data-driven insights into the global collector car market, assisting enthusiasts, collectors, and investors in making informed decisions. The discussion delves into how Motorcopia’s detailed reports and data analyses help users determine whether to buy, sell, or hold specific car models. David emphasizes the importance of balancing passion with practicality and the role of elements such as preservation class and restoration in determining a car’s value. Additionally, the episode features returning co-hosts Don Weberg and William Ross, who contribute their expertise and insights into the intricacies of the automotive world.

- David, you’ve had a long history in the collector car world—what inspired you to launch Motorcopia.com, and how does it build on your past experiences?

- For those unfamiliar, how would you describe Motorcopia and the kind of information it provides to collectors and enthusiasts?

- What types of data or insights do you find enthusiasts are most eager to explore when it comes to auctions and collector cars?

- How do you see Motorcopia serving both seasoned collectors and those who are just beginning their journey into classic and exotic cars?

- With so many digital platforms emerging, what sets Motorcopia apart in terms of both its content and its mission?

- If you look ahead five to ten years, how do you think data-driven insights will continue to influence the collector car industry?

Transcript

Crew Chief Brad: [00:00:00] Break Fix podcast is all about capturing the living history of people from all over the autos sphere, from wrench, turners, and racers to artists, authors, designers, and everything in between. Our goal is to inspire a new generation of Petrolhead that wonder. How did they get that job or become that person?

The road to success is paved by all of us because everyone has a story.

Crew Chief Eric: Tonight we are joined by a familiar name in the world of collector cars and automotive journalism. David Neyens known for his deep expertise in classic and exotic automobiles, has long been a trusted voice in auction catalogs and in the pages of enthusiast publications. Now he’s bringing that wealth of knowledge with Motorcopia.com, a unique platform dedicated to the intelligence and insights of the global collector car market

Don Weberg: from auction analysis and pricing trends to the fascinating stories behind the cars themselves.

Motorcopia is redefining [00:01:00] how enthusiast, collectors and investors understand the marketplace. In this episode, we’ll dive into David’s journey, the vision behind Motorcopia, and how data and passion are merging to shape the future of the car world.

Crew Chief Eric: That’s right, and joining us tonight are returning co-hosts Don Weiberg from Garage Style Magazine.

And William Ross from the Ferrari Marketplace, not just personalities on the Motoring Podcast network, but our car auction subject matter experts. So welcome back Don and William.

Don Weberg: Thank you.

Crew Chief Eric: This is gonna be fun. And with that, let’s welcome David to break fix.

David Neyens: Hello David. Hello everybody. Nice to meet you.

Crew Chief Eric: Like all good break, fix stories. Everyone has a superhero origin. Let’s talk about your long history in the collector car world. And what inspired you to launch Motorcopia.com and how does that build on all your past experiences?

David Neyens: Ever since I was just a little guy, I was always just obsessed with automobiles in general.

After a about 10 year stint in financial [00:02:00] services and banking was able to get into riding for a nearby collector car, auction house, and writing their catalogs. After a few visits, one of the tour guides, uh, mentioned he thought that I should give catalog writing a try, and that there might be, uh, an opportunity there.

So I purchased prior auction catalogs and just went over them just like I would a magazine or a book just kind of modeled their format and their style. Back in 2007, uh, unboxing day, I had the opportunity, I saw an ad actually where they were looking for catalog writers. The deal was you submit a test piece, pick a car of your choosing and give it a try, and if they.

Liked it. Then there was the possibility of an interview and a job working in the writing cataloging department there. As it happened very quickly, I was told they liked what I submitted. They were super busy with private collection sales and scheduled auctions. Asked if I’d be willing to interview, and they brought me on board pretty fast.

So that’s how I got my first few years in the business. After that went on my own in 2012 and, uh, with some help from a very good friend, uh, in the PR [00:03:00] industry in in California, Cindy Mele, she helped me to launch my next phase as a, as a freelance catalog writer and just became extremely busy. It’s been really rewarding.

I’ve met a lot of great people, uh, made a lot of great contacts with people and just continue that journey right to the present. And as far as Motorcopia goes, uh, as a new venture. That started back in May and June. I finished a major project for a customer, submitted my invoice and I’d been feeling a little bit tired, and then realized by then that I’d caught a terrible cold that put me on my back for about a month.

During that time, I thought, well, what can I do in addition to writing catalogs on my own where I can continue in the car field and, uh, try to do something different? And so the idea for Motorcopia came about. A lot of content creators do a better job of putting out great photography, great videos, online content.

That’s their space. With me being so deep in the market for so long, I decided to take data associated with collector car sales, process it, and [00:04:00] turn it into something that’s actionable for collectors and high net worth investors. People in, uh, their professional advisors as well, where I can give a buy seller a hold signal and also drill it down to specific models of cars, even.

Again, it was just simply because I was trying to find something different, something a new niche that no one else is really pursuing.

Don Weberg: Can you tell us exactly what is Motor

David Neyens: Copia? I was kind of inspired by, uh, there’s a fellow in, in the States. You’re all in the states. I’m in Canada. He, he writes, um, a newsletter that’s all about farming and agricultural commodities, investment strategies for farmers so that they can hedge their bets or get their crops to market at the right time.

Or maybe they hold onto them in a facility and they then sell them when the conditions are more favorable. That’s his business. He, and it’s just a no bones about it. He was a Chicago Board of Exchange trader at one time and just loved it. And he came from a farm and that’s what he did. So for me, it’s being able to take my love of cars.

Well, I love them all, but [00:05:00] you know, there’s some that are more electrifying than others or that are in more demand than others, and they actually apply a bit of a financial method to helping people to make decisions.

Don Weberg: But is it an auction platform? Form what? What are we looking at here?

David Neyens: What it is, it’s an information platform.

Think of it as kinda like a Bloomberg terminal setup for investors in the collector car market, or people that have high end collections and they want to know whether they need to buy, sell, or hold certain cars. Also, there’s the Motorcopia newsletter that works right from the website and with that I send out like a financial newsletter, but it’s geared completely to the collector car market and there’s a lot of crossover with the financial markets.

It’s a real hardcore nuts and bolts analysis. If you’re looking for good content and great pictures and stuff like that. I try to deliver that. The emphasis is on helping people to buy, sell, or hold and make those decisions with clarity.

William Ross: My opinion, you don’t need to worry about the pictures and that stuff because what you provide to someone is.

Basically the data and analytics down to specific models, which is fantastic for someone that’s [00:06:00] a very numbers driven Oh,

David Neyens: oh, right on.

William Ross: For those who have not gone on the website, you need to go on there. And what’s great about it too, it’s not like it’s crazy where it’s like, you know, you get some of these data driven sites, you get all this data so that you really, it’s kind of hard to make all It is so nice and concise.

It’s very straightforward and you can understand exactly what you need to find. To your point, buy, sell, hold. Just history of car, especially if maybe it’s just your car you’ve had for a long time. Hey, where’s my car sitting at in the market right now and what’s it been doing the past five years? If you haven’t been on site, you guys gotta go on the site ’cause it is really, really cool.

Don Weberg: Thank you. If I’m understanding correctly, if you go on the site, do you go back five years and show what those cars have been doing on the market, going up, going down, doing whatever? Is that what we’re kind of getting at?

David Neyens: Yeah, I’ve done two reports, really deep dives into the four GT Heritage Edition, the oh six four GT version.

Where that sits in that relationship, is it if it’s a buy, sell or a hold, the report breaks it down into immediate the next 30 days, one month to three months for short term, three months to 12 [00:07:00] months for a medium term, and then beyond that for a longer term view, sometimes a vehicle can be. An immediate term hold, but give it a year and it’s a buy depending on our forecasting, so we can drill right down and make forecasts.

And then I try to back test as well after certain auctions take place. Like at Monterey, I believe there are five or six of that four GT Heritage Edition that were offered and or sold. So I could look back and see, okay, was reserve too high on this offering? Was it priced right? What did they solve for and what does that mean for the future for those cars?

Because they were heading on a trajectory for a million plus dollars and really the sweet spot’s somewhere around 700, 750 right now for those cars. That’s borne out by auction experience and sales experience, online auctions, and also if there’s any private sale data that’s known.

Don Weberg: You picked on specifically the GT heritage.

Why that car? How do you choose the cars that are on the system? How many cars are on the system

David Neyens: Right now, I’m doing it more on a [00:08:00] demand basis, and I’m also picking and choosing bellwether type cars. That would be like a blue chip in the market. Something that’s got a certain amount of confirmed sales.

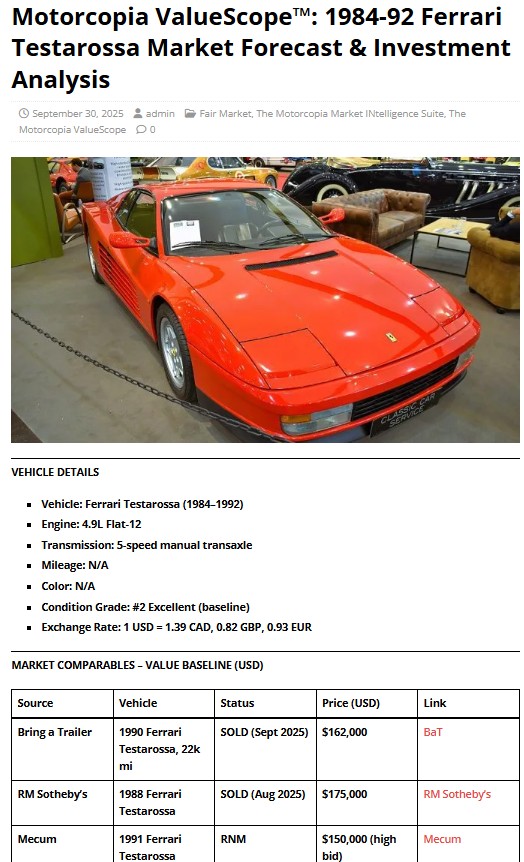

It’s got some interesting dynamics in the market as far as pricing, and this one was heading higher and now with the airs come back out, it’s still in high demand, rare limited edition. That’s how I picked that. It’s a bellwether. I’ve got another analysis, two different methods on the, uh, first generation of the Ferrari tester.

84, 85 to 91. The same idea. It’s a solid hold right now, but there’s upside potential still. The tester had almost 7,200 built. 71, 77 I think was the bill number. At least what’s accepted. The idea is, okay, there’s enough of them built where there probably are enough sales and enough attempted sales that I could find lots of records for the past five years online that.

Don Weberg: Would

David Neyens: help me to build that model as to why it’s a hold right now and it, it’s approaching a buy actually, and I believe one of my reports was [00:09:00] calling for a median of about $160,000 for a number two example, which is an excellent car, but not a Concord queen. Not a driver. So that’s sort of the standard baseline I go by is an excellent conditioned car, unless the customer tells me what the condition of the car is.

So I’m using haggerty’s one to four scale for condition. So that’s kind of one of the criteria. I’m using. Two things I do. One’s called the buy, sell, hold index, and that one’s a weighted average system. I get a score out of 10, I’m looking at 16 data points. One would be recent sales trends. The other one is, uh, market liquidity.

How frequently is this year, make, model or type of car appearing on, on auctions and auction websites and live and online. I’m also looking at how these cars are selling at auction. Do is what’s the sell through rate for them? Community, sentiment and buzz. So I’m also looking at what’s going on online and in print.

How often are these cars discussed or talked about? Is there a lot of nostalgic tailwinds to them to spur them on a little bit more? Was there TV use, like say [00:10:00] Magnum, pi, Ferrari? You know, that sort of burned into my memory bank and probably judging from the four of us, that might be something that we identified with as young folks.

Ownership costs and how complex they are to service, how costly they are to service, or how cheap they are to service. I like the test. I gave it a three out of 10 for ownership costs and maintenance costs. But you know, you could take an 84, 85 to 93, uh, Fox Body Mustang five liter, and you’d probably be looking at eight or nine for a score because their parts are available readily and they’re relatively inexpensive.

The other thing is, again, cultural and historical significance. Was there a competition history or like, say a copo Camaro from 69 ruled the drag strips. They were, uh, burned in everybody’s memory. Banks. That’s, you know, anybody up to around Gen X and millennial. That gives a good tailwind as well. Is there export and import demand?

Are there a. Cars crossing the border, say from Canada to the US or Europe to the us I’m also looking at regulatory and legal pressures depending on what the jurisdiction is. So, as you know, in [00:11:00] England it’s ultra low emission zones and uh, you can’t park anywhere. Whereas here in Canada, it’s uh, electric vehicles are getting pushed like crazy here and we’re being sort of coerced into that space.

Despite my opinions about that, how rare or how common are the cars, things like that. So again, there’s 16 data points that I’m going over with that. But you want something that’s got some action. So these are just sort of test cases where I’m publishing them myself right now to show people what I do.

William Ross: Because it is interesting with the tester because as I was leading and I kind of chuckle myself. Some years ago, the flying mirror cars, I either the Monte spec or however you wanna pronounce it, were not the car anyone wanted. They wanted the two mirror only that, but now it’s gone the other way. Now people want the flying mirror.

Yeah. So it’s got a little more value to and stuff, and it was just, it makes me chuckle towards the end. Then you got the TRS and you got the five 12 M. So it’s got those variants in there where those variables are there. But it really can kind of say like, pinpointing is like going to your customer, saying, okay.

What are you looking to buy? What are you trying to achieve with it?

David Neyens: Yes.

William Ross: It’s like, well you could have this low build towards the end production, final tweaks, [00:12:00] beginning, build, flying mirror, you know, you need this da da da and that kind of stuff. But you know, you have everything going across it, which I thought was really neat too.

’cause you usually don’t see that is not only did you have the sell, but auction ones, you know ones that didn’t. And I mean, someone that’s looking into buying up test row potentially. Don and it’s great information to really make an educated purchase because you can see where it’s at. Exactly. Now what I tell my people is like, look, you know, if you’re buying this as an investment and think you’re gonna make money, that’s not the way to buy a car.

But if you wanna, you got the data that’s backing up, which is fantastic ’cause you can really see where things go and that, that was a great example. You know, I mean, you nailed it. It’s a great bellwether in regards to putting information out there. One, there are enough of them built, but also enough variations of it technically.

Okay, what are you looking to do? Or where would you wanna be at? And because it, it’s an awesome site.

David Neyens: Thank you. It’s fantastic. And to get that some granularity to what value and sort of what the, uh, the recommendation is. So it’s kinda like on CNBC or whatever, they’re saying, this is a buyer or a sell, or I recommend this kind of thing.

It’s a bit of a dangerous thing. So I have to [00:13:00] say, here’s the data to support what I’m saying. You’re an adult and you’re a decision maker. This is meant to guide you and your advisors and to help you to make those decisions yourself.

William Ross: Yeah.

David Neyens: But yeah, there’s so many variables. And the other thing is classic and collector cars is such a passion driven field and it’s only exploded over the last 10, 15 years.

And I did a report on the, uh, 1989 to 94 Ferrari apocalypse. I called. There were a lot of enthusiasts, but there was a lot of speculation, a lot of Japanese money that was in the market. And a lot of those cars have since been repatriated over here to North America again. But I remember that very, very well, uh, as a student because always had a love for classic cars and collector cars.

But getting the analysts take on and in the financial papers was kind of eye opening for me. I think we’re in a much broader market. There’s a much more solid base to work from in the market today, and a lot of the online auctions and a lot of the live auctions with the cars that they’ve expanded into.

Enthusiast cars, Japanese cars, [00:14:00] BMWs, A MG, Mercedes, stuff like that. Where people are really getting into it and very fiercely loyal. It’s just made everything better for everybody, a lot better base to work from. It’s not as peaky as it used to be or as focused on one mark or one type of car.

William Ross: Do you see AI playing some type of role in this in regards to the data and everything like that?

David Neyens: You have to be extremely careful with AI as it stands right now, and it’s never. Something you can rely on 110%. You have to really question everything. I think it actually demands as much diligence as being an expert in a certain field and doing your own research. You still have to question everything.

You still have to double check everything. Even if you use it. It’s a tool. It’s a help. It doesn’t replace what people are already doing. No, I agree. Yeah, it, it’s just one of those things that if harnessed properly can be powerful and helpful, but if used lackadaisically, it’s going to show. As such.

Definitely.

William Ross: When someone comes to you for a report, what’s their number one compared to their number five in regards to, this is what I’m looking for to get out of this [00:15:00] report? What are they really trying to delve into and get out of it?

David Neyens: Ever since I’ve gotten into the business as a catalog writer, you’re in contact with owners all the time, unless you’re told not to contact somebody.

I’ve had so many conversations with so many great people and and the number one thing is, Dave, what do you think my car’s worth?

William Ross: Yep. How much can I get?

David Neyens: Yeah. Well, I’m not a qualified appraiser. Right. You have to be so diplomatic when you’re dealing with people. ’cause it’s also a very emotional thing. A lot of people are very attached to this type of thing, more so than other luxury items.

Like I call them alternative assets. I mean, you know, some people are really turned on by the wines they have in their cellar. Okay, great. But it seems like the passion component or the emotional aspect of ownership really attaches to collector cars. Very much so. But what do you think my car is worth?

And I have to kind of steer the conversation away. Yeah. Because it’s outside my pay grade or here’s what the reserve is. Do you think that’s right? And everybody’s always looking for a sounding board. They’re always wanting to know that they’re making a sound decision. Oh

Don Weberg: yeah.

David Neyens: Yeah. The other thing is auction estimates.

Always problematic. That [00:16:00] takes a lot of handholding as well. So that’s one of the things I do in one of my reports is, uh, help out with suggested reserve prices and suggested estimate ranges as well. And, and the other thing, an appraisal is a snapshot at a specific moment in time and things can change.

So I have people that would come to me and they’d give me an appraisal report that’s four or five years old and I’d have to gently tell them it’s way outta date. And yeah, you need to have another one. I recommend you get another one. And I have a list of people. That you may wanna choose from, but this is sort of a tool that can help with that process.

They generate comparables, which really helps as well. I’ve seen some appraisal reports, not everywhere, but I’ve seen them where it just says, this is the type of car that does very well at certain options. And there you go. So you have to have the due diligence, you have to have comparables, you have to have a methodology as well.

So that’s baked into those reports as well

William Ross: as, you know. An auction sale number can a lot of times not really indicate true value of that car. ’cause who knows the two people buying us like that. But then you also have, okay, like retail sales, you know, market out [00:17:00] there price. That was fantastic too. ’cause you know exactly why that thing sold for that because so and so and so and so were bidding over so it went $500,000 over the high, that kind of stuff.

Whereas, okay, here’s reality. ’cause again, like a client comes to you, they have a car. What can I get or what’s my car worth? Well, it’s like, well, here, let’s look at the numbers. But then it’s also, well, we gotta look at your car too. ’cause this is what there’re, but we gotta see where your car’s placed at.

Exactly. You have all those different pit points that you can kind of say, say, look, here’s an auction thing. Here’s privacy, here’s retail. You know, here’s what it got bid to. It didn’t sell. Say on bring a trailer. You have those numbers too. Well, it can really give. Someone for like me going to someone with their car wanting to sell it, they’ll go like, here, you know?

Right there, it’s straightforward. It’s giving you exactly what you’re looking for, where you wanna be at, and give yourself a good, educated decision. You know, obviously when it boils down to it, you can give all the details, info you want to the owner or whoever, but they’re gonna make their own choice.

Don Weberg: Yeah,

William Ross: that’s right. You know, you don’t want them to burn themselves out there and go, oh, I think my car’s worth 2 million when it’s worth one. You know, that kind of stuff. Oh, yeah. You know, [00:18:00] because then the car’s done.

David Neyens: That’s right.

Crew Chief Eric: As I’ve been listening to you guys talk about the valuation system of the vehicles and how the metrics are put together and how the data is analyzed, there’s a very important undercurrent here that I think we need to address head on, which is worth versus value, and they are not the same thing, although people think they are synonymous.

But I just wanna understand where the high watermark is because if I was an investor looking at, let’s say, the Testa roaster report. I’m not seeing the appraised value, which for me is the high watermark of what the vehicle could sell for based on what I’ve been told by an official in the market versus to Williams’ point, what the auctions are saying because the auctions are subjective.

If I got into a bidding war with you and that car is suddenly $500,000 over, if I’m a data analyst, that to me is an extreme that gets taken out of the equation.

David Neyens: Yeah, it’s an outlier.

Crew Chief Eric: It skews the data set. What is the tester Rosa actually worth? Based on what the appraisers are saying versus when the gavel [00:19:00] drops.

That’s why I want a little bit of better understanding, and I have a feeling the audience is sort of wondering, how does your math work when you come up with these valuations?

David Neyens: I use, uh, number one, the number four condition grades for specific vehicles and mileage. Mileage would go into the equation to colors, even colors.

Some are far more rare than others that help influence the market value. As far as appraisals go, I, I wholeheartedly agree, someone needs to actually see the vehicle needs to take a look at what I’m doing, but they need to look at the vehicle itself, of course, and that can be different than what’s been selling in the marketplace, where the numbers are coming from.

I’ve seen many times where an appraisal comes in. 10 to 40% higher than than what an actual market value is. Depends on how recent it is as well. It’s the same thing as with a real estate appraisal. When I was in banking, you’d have a, a market value estimate from the appraiser, but you’d also have a replacement value for the physical item.

You know, what it would take to replace it. And those are always two different things as well. Mine is based more on market and momentum. If there’s good buying activity or [00:20:00] selling activity, if there’s any kind of like a velocity in the market where cars are moving or not moving, it would pick up on that as well.

Crew Chief Eric: But doesn’t that fall victim to the same adage in housing, which is your house is only worth what someone is willing to pay for it. At the end of the day, regardless of what the numbers say in the house buying process, the appraisal is over what it’s selling for or it’s under what it’s selling for. So we’re in that same game.

So the car is worth what someone is willing to pay for it at the end of the day, right?

David Neyens: Yeah. You need willing buyer and a willing seller and a, and a reasonable. Timeframe. Yeah.

Crew Chief Eric: So going back to the data to establish trend. Mm-hmm. You still need a, like in science, you need a constant to test against, in your case, for your data set, what is your constant?

Is it mecu M’S value? Is it Sotheby’s value? Is it an a private appraisal value? ’cause you have to have something across the vehicles to make it consistent.

David Neyens: Oh, for sure. Where I get my numbers, I make a weighted average to get my score that I score a car at out of 10. So. Let’s look at the tester example here.

Sure. Let’s stay with that. I’m looking at not only the different auction houses online and a and [00:21:00] live, one of the biggest tools I use is actually classic.com, if you’ve seen that, where it has a rolling five year, uh, scatterplot of all the sales that have taken place and listings, even if it’s unsold. So that’s a huge tool to use.

So I’m going back as far as I can through that. I use, again, a condition multiplier. My assumptions are based on whether or not a car, unless I’m told otherwise, is an excellent number two condition. If it’s a Concor quality car, it’s gonna have a 20% multiplier. If it’s a driver, number three, we’re gonna take the baseline down by 20%.

So I’m looking at sales trend. For the value scope that I did for the test aero, I’m looking at rarity or commonality. So the score will be higher or lower for cultural significance. So the, the test aerosa gets a bump, it’s like a nine outta 10 as far as its, uh, pop culture status cost. I also look at maintenance costs and service costs.

The higher, the worse it is. So I’m not a mechanic, but I think you need an engine out just to do the timing belt. So that’s weighed into this as well. Demographics, which generations are, are into these cars or not, and whether or not [00:22:00] these cars are steady at the auctions. Definitely this is meant to supplement or assist in the process.

I always tell people to get an proper appraisal, get a recent, a fresh one, so you know also what you’re dealing with in terms of condition and comparables. With this, I’m coming up with 160,000 US for that generation of tester, Rosa, if you’re looking for a sale, and as far as reserve prices, so if you’re taking one to auction,

Crew Chief Eric: just don’t want listeners to think that, well, this is the Kelley Blue Book for classic cars.

’cause it’s not.

David Neyens: Gosh, no, no.

Crew Chief Eric: Because if you think about the things that you’re describing and the one to five scale and take into account mileage and the options and the color and that. Mm-hmm. Kelly does the same thing for pedestrian cars. Yep. We wanna make sure that we differentiate when we’re talking about this.

Maybe this is a future capability. Say I’m going the other direction and William and I have these conversations all the time. I got 200,000 to spend. So tester Rosas on the list, but how does this compare to maybe a car that’s older of more significance or a car that’s newer that might not have all these mechanical issues like you talked about engine out to do timing [00:23:00] belts.

Chain driven Ferrari where I can spend 200 grand and still have a V 12 or whatever it is. So, comparables across vehicles or is that yet to come?

David Neyens: That’s something I’m gonna be rolling out a bit more as I, as I evolve things. The biggest thing is if you’ve got a more rare car. It’s going to score higher in my scoring matrix.

If it’s easier to maintain, that’ll have a better score too. So you could take a car that’s less exotic, but perhaps more rare in terms of build numbers. It’ll have its own scores and weightings that’ll help us to determine value, but it also ties into what auction and online, offline, and dealers are selling for.

But there might be a chance to identify through this system, a car that might break out to the buy side. Or one that’s already been loved in the market and it might be time for a pause or a break in selling or, or value. So it just depends on the individual, you’re make and model kind of thing. And it, it’s individual attributes Above all, you know, this should be something that would be considered to help with selling, marketing, and auction set up for a [00:24:00] car like this.

Always have an appraisal though from a, an accredited appraiser in combination, I figure that more information is better than less. Of course.

Don Weberg: David, are you primarily focusing on the exotics on the Ferraris and Lamborghinis of Porsches, or are you gonna grow this out to. As Eric always has more pedestrian type cars.

I mean, for example, the IROC Camaro Yeah. Is absolutely going crazy right now. They are, and that to me has always been, I mean, I don’t wanna say surprising. I’ve always liked that car. Always knew it would be somewhere I don’t think I knew it would be this. Somewhere. So is that a car that’s on your site?

Are we looking at oddballs like for a name? Taurus, SHO. Yeah. That car is slowly starting to percolate or are you sticking to that narrowed? We love exotics. Where, where are we going with this?

David Neyens: Yeah. The starting point was just me doing some test cases and then illustrating the methods that I’m using to get my numbers.

If it was anything, like you said, uh, an IROC from the eighties and there’s a couple of different flavors of them, enough [00:25:00] that you can break that down into more granular. Types of cars inside of them? Like are you looking at the five liter or the 5.7? Are you looking at the one L?

William Ross: Yeah, it’s got the compact.

David Neyens: Yeah. I’d love to tackle those because there’s a huge amount of sales data on those and the good cars, like the really nice unadulterated original cars are so rare in that space. It’s like fox Mustangs. But I think what I would do is I’d have to break it down like you said, and thank you for that. You said the iroc, so that gives me more certainty with what I’m dealing with.

The only difference would be powertrain colors and condition and mileage. That’d be an interesting test case. So if someone wanted me to do that, I, I, I’d be happy to run one and, and just so they see it, because that’s a, a more mainstream car right now. It’s like second generation F bodies are starting to kind of make a nice breakout.

They were everywhere and people just kind of went, we like ’em, but we don’t know why. They’re not really doing much in the market, and you can buy much more powerful cars or this, that, or the other thing. But they were very special for their time. And now [00:26:00] people like me, I had a 10th anniversary, uh, TransAm back in the eighties that I saved up for with farm money and lawn mowing and hay baling money and tobacco picking money.

And that was my first car. And, and I absolutely adored it. But now second Gen F. Bodies are starting to get their due a little bit in the market. So I’m appreciating seeing those kind of cars that were produced in larger numbers, having attention now with enthusiast. Yeah, absolutely. I’d love to see what fits a buy seller.

A hold over my four time periods.

Don Weberg: I brought up the Camaro ’cause it’s a common, and it’s certainly not in the, uh, in the ballpark of pastor or tta or any of those guys.

Crew Chief Eric: That’s not necessarily true, Don. And that this adds another use case. To the equation here in that you have cars crossing the block in Mecu at Barrett Jackson at other auction houses where you have a modified Camaro or a Resto Modd Camaro, or something that is, you know, is a SEMA quality car, which is beyond concourses level.

Is that being taken to account here? Because those will sell for $200,000 all day long,

Don Weberg: right? Yeah.

Crew Chief Eric: David, how are you absorbing those [00:27:00] modified versions instead of the original purist cars?

David Neyens: I think that the modified cars, especially F Bodies and Corvettes, especially second generation Corvettes, there’s just so many of them that are built to that standard that are restomod, couple of orders of magnitude better than the original car in terms of what it’s like to drive or operate.

What I would do in those cases is separate that out, you know, look at the modified cars more in isolation that are done to a show standard as opposed to something that’s more original.

Crew Chief Eric: It changes your metrics again, because those cars need to be considered, let’s say they’re numbers matching. Even though they’re modified, they still are in the same category as a numbers matching stock car.

Why would we take them out? It gets a little gray really fast.

David Neyens: Well, if the car that the customer’s asking me about is a stock or a modified car, then that’s where I’m gonna have to like break that out. So I’m comparing apples to apples instead of apples to oranges. That’s why I started out with four GT Heritage.

That’s a very uniform car. Unless it’s been modified and there are a few out there,

Crew Chief Eric: like you were [00:28:00] saying before, what’s my car worth? And somebody says, no, David, that’s not what it’s worth. I just saw a Copo Xma car go across the block and it’s 250,000. Why isn’t my Camaro 250,000? Right? So now you get into this tug of war again of worth versus value.

So I wanna make sure that we establish that so people really understand what the intrinsic value is versus what it’s worth. So one is more subjective than the other. I know I keep harping on this, but I think it’s important for the first time collector to understand that you just don’t walk up to an auction, go, I want that one, or I’m gonna sell mine because I saw that one.

Right? It’s not a monkey see, monkey do situation.

David Neyens: Now I’ve seen people do that actually walk right up to me at an auction and just say, how much is that car? I wanna buy it right now. I didn’t buy it last night. There are people out there that are like that. Again. Yeah. I’d have to parse out is the car modified?

Is it standard? Is it, you know, rest a monitor? Is it just lightly modified? I mean, headers and duals don’t make anything too much of an outlier. In this case. It’s gonna be a little bit of a custom job.

William Ross: I always like that there’s expectation. There’s reality [00:29:00] that I always like, ’cause people have this expectation.

But then here’s reality.

David Neyens: Here’s where I found the gap is widest is dealing with. An enthusiast type car that someone’s owned for a while and they have a bit of an emotional bond with, there’s a, an older couple, a few years ago they had a 56 Ford Fairlane, crown Victoria. They’d owned it for 30, 35 years.

They loved it. They went cruising with it, but it’s a driver. They were so attached to it that, again, when you’re talking about value versus worth. They had 30 years with it of fun cruising and showing they bought it when it was not worth comparatively as much as it is now. And certainly inflation also figures into the numbers that people are expecting to get from a car.

A million dollars today was a hundred thousand dollars about 15 years ago, or 20 years ago. I’m exaggerating a little bit, but there’s a big gulf based on inflation. So I said to the pe, the lady I said. What do you have in mind for a value? She told me and I said, now, just so that you know, in this market right now, that’s a bit on the high side, and you know, does the car owe you [00:30:00] anything?

Do you owe money on it? Was there a huge expense that you’ve had over the last few years that’s going to affect your decision? And often a lot of people. When they’ve made a big investment in a vehicle after buying it, they feel they need to recoup that last dollar they put into it. And that’s another thing.

But I’ve seen the gulf between market value and personal value or worth is huge on the more mainstream side of cars. A lot of people on the higher end of the market are kind of dialed in and they want to do the best when they’re selling and they wanna do, do the best when they’re buying and get the lowest price.

But I’ve seen it more on the sub $50,000 car market where there’s that kind of golf cars can even, like, depending on where they come from. I’m not drilling down into that aspect of it right now, but there’s certain markets or certain locations where cars are just uniformly of better quality. Especially in the mainstream side or the enthusiast side.

William Ross: Obviously you know, you’re doing these for a customer or client, you know, so it’s obviously model specific, but what is driving you to put ones onto your site for general consumption? Yeah. How are you picking what to put on your site then? Because obviously the tester was a great [00:31:00] example. I think the four GT one’s a great one too, because you know it’s a very popular car, but how are you going about picking those, what you’re gonna put on the website for just general consumption?

David Neyens: For those that are like test cases that I’m publishing proactively, there’s a finite bill number. Now the tester is not particularly rare with over 7,000 built, but it’s far more rare than a lot of other exotics and uh, high performance cars despite that many being built. The tester is styling the cultural status of it.

You know, having been on Miami Vice and that whole thing. I think that just is a good test case because that’s something that a lot of people, whether or not they own one or plan to own one, they can at least identify with to some extent. The four GT on the other hand is that Heritage Edition is just.

Really rare. There’s no question as to whether or not they’re real or faked. That’s the other thing. Unlike some vehicles that out there that have that potential, both of ’em. I mean, I’ve only seen a few modified gts, let alone a heritage that’s been modified and tester roses. I don’t see them being modified very often at all.

No, you don’t. So it’s a nice case because they’re fairly uniform [00:32:00] in that subset of cars. Or the models that their manufacturer made. So I thought I’d try those because I think there’s some rarity to them. There’s some visual impact. The performance aspect is interesting and they’re just interesting cars all around that.

People, I think, would gravitate to just to throw that out there just to show what my different tools, if I run a certain year, make model through those filters. Is it a buy? Is it a sell? Is it a hold? What are the timeframes for those things?

William Ross: It’s a good example for, I would say a sales tool for you in regards to getting clients.

Yeah. They see that. They’re like, oh, okay. It’s a good basis to work from for somebody to get the idea of what you’re capable of doing. That’s what I took from that. I was like, wow, this is great. If someone sees it, Hey, I want an individual report, that the right thing. It’s like, there you go. It says it all right there.

So that was fantastic.

David Neyens: Sort of just a couple of test cases. I’m gonna keep rolling them out and also the market changes. From auction to auction or there’s trends definitely. But the idea is eventually, uh, those reports will need to be freshened up a little bit and to see how they compare. So maybe a year from now I go back and just have a look at how do my calls hold up.

And the idea is if they [00:33:00] hold up or maybe there’s some tweaks that need to be made or maybe something happened in the market in general that’s, uh, affecting market values in that space. Say the 250,000 and over, or the a hundred thousand and over market segments.

William Ross: Yeah. How are you going to make. That decision to go back and revisit something to adjust it to your 0.6 months or a year, I mean, or you just go, oh, the market seems to be gone a different way.

I had just done that, so I better go back and do it. I mean, you could have a set time maybe, or just gonna say what the market does, if it necessitates it to do it.

David Neyens: I was doing a forward market index looking ahead the next 30 days in the market, and then to get a score as to just the market in general, its health.

And whether it’s bear neutral or or a bull market, kind of like in financial terms. What I’ve done now is I’ve changed that to weekly. So I’m doing weekly forecasts. Right now. I’m only getting them published Tuesdays or Wednesdays, but it’s for the week ahead. Then afterwards, when this week is over on Monday, I’m gonna run a report and that’s the market pulse and that’s my Fear Andre Index.

And I’m gonna say, [00:34:00] how did my forecast hold up against reality? I’ve done a couple of posts now that show that both the weekly forecast and then the look. Back the retroactive look. Those are both now pretty closely aligned. So it’s, it’s showing that the methodology is jiving. When I make a forecast using my system, when I look back the next week, they’re almost in line with each other perfectly.

So, yeah, I, what I’d probably want to do is maybe a month to three months out at the end of the year, say, how did my report on the test Aerosa workout? Did that logic hold up? Did my call on the four gts? How did that hold up over this period of time? You just do a little bit of back testing like that just to show that it’s working.

William Ross: I like how you’re, you’re referencing t how did I do? Yeah, in regards to forecast, which is great ’cause a lot of people would bury it ’cause they don’t wanna look like they prove it wrong or had no idea. But anyone that knows this industry and business, you never know. I mean, you can use all the numbers you don’t know, but I really like that too.

Yeah. I was like, look, here’s how it went

David Neyens: and I don’t have anything to hide. I’m just putting this out there. This is my method. Does it hold up? Okay, great. It did hold up. So I’ve [00:35:00] had two one week periods where the, uh, forward look and the look back were in line with each other. They almost had the same scores, you know, so the look back is the reality and the look forward is the forecast.

Of course, that seems to be working. One of the things I’ve worked in is sort of geopolitics a little bit too. You know, how’s the news? Is it bad or is it stable? Or is it good? You know, or is everybody getting along now? In this week’s newsletter once I get it out. Finally, the first post is I’m breaking a golden cardinal rule here.

I’m actually discussing politics. One of the things I should be talking about, but here’s a buffet of seven potential black swans that could land anytime. I don’t wanna throw cold water and everything. The market’s been good. The market has breadth. There’s a wide market. There’s a huge number of types of cars, classifications of cars, enthusiasts to investor grade and everything in between.

So it’s not like the narrow Ferrari market of 35 years ago, and that’s it, where it’s very risky and speculative. Also, the last 25 to 30 years, there’s a just a [00:36:00] massive amount of money in the system, despite the news you hear. There’s people that are getting huge bonuses and they have to put it somewhere.

There’s only so much real estate you can buy. There’s only so much fine wine, cigars, time pieces you can buy. So, so that’s where the, our market’s, uh, really been getting an uplift as well. There’s a chart, I’ve got a report on showing insider buying and selling of stocks, but with one or two brief. Moments since 1998, company insiders have been selling stocks and freeing up capital and buying cars among other things as well

William Ross: can be a lot more prevalent.

I mean, you’ve seen it now where they got the investor goose, whatnot, buy a chair for $20 and whatever, you know?

David Neyens: Oh, yeah. Like the fractional ownership. Yeah. Yeah. I’ve only just recently seen four or five of them where there were one of them that’s kind of cropping up right now. It’d be interesting to see how that goes.

I mean, what I’d like to do is actually build a list where there’s a specific set of, say, 20 different year make and model of cars that have the most potential to be good to purchase. They’re not overpriced right now. They’re emerging as collectibles, and someone could put a fund [00:37:00] together or put a group together or for themselves and use those reports as guidance.

To build a garage full of great cars and hopefully enjoy them. It’s not all about the money. Drive ’em. Absolutely. It’s a major consideration for people getting into purchase or getting into the market. But for me, it’s the love of them. I see stuff on marketplace every day. There’s beautiful cars being sold for less than 10,000 Canadian dollars that have less than 50,000 miles on them, and they’re fun and interesting.

You don’t have to spend a huge amount of money on something like this. It can be a really fun hobby. I think the biggest thing is, for me, it was just simply. There’s other content creators out there that are doing that job so well and building their niche so well. I have rudimentary skills with a camera.

Forget video. There’s other people that have bigger followings or they know how to work the algorithms to get the right response they want. For me, it was simply, I’d like to see if I can add some value to people where you can take a look at these reports or you can order a report from me and I can build it.

And then that gives you some [00:38:00] confidence as to what you’re doing. Or maybe it’s a confidence in something you’re not doing. Maybe it’s saying, I better just hold onto this for another year. If it’s not costing me money, if it’s not hurting me, maybe I just hang onto it.

William Ross: This has been interesting. In the past few years, there’s been an explosion in regards to value in classic race car.

They’ve been going to the roof and you have log samples going across the board. You know, we had X collection go for 650 million. I mean, that was an incredible thing, but. Would you be able to do a report on someone that’s looking at, Hey, I’m looking at this XY, ZX formula, the one car from 1969, or you know, old Lamont’s car.

Is that something you could potentially do as well for an old race car?

Crew Chief Eric: And I want to dovetail off that, William, because I think now when David takes that into account, he needs to invert his scale because a concourses quality race car never raced. Yeah. Right. You want the one that’s the driver with the miles.

Yeah. That won a championship. So you actually have to skew your data set opposite for this. Yeah.

David Neyens: For a competition car. Exactly. Yeah, because you, you have to have some earmarks of actual use in [00:39:00] combat or in anger. There’s a Jaguar D type once a few years back. I think it brought over $20 million at auction in Monterey.

That was achieved, even though that card had been beaten up so much that the chassis tag was the only thing, and the, and a stamp on, on one of the frame rails was all that was left of it that actually crossed the finish line At Lamont, there’s a lot of Ferrari that have been re bodied or whatever, and it’s part of the story.

The one of the coolest ones for me is that two 50 GT uh, bread wagon. I used to know the fellow that owned it one or two owners ago, and he raced it in vintage races.

Crew Chief Eric: We saw it this summer at Lamont Classic.

David Neyens: Yeah. Yeah. And it’s driven, right?

Crew Chief Eric: Oh yeah. It was raced at full tilt this summer. Yeah. Yeah. And it’s, and the thing

David Neyens: about it though is, okay, so a lot of body panels, it got stuffed a couple times and it’s mostly there.

And you know, some expert redid the body, I mean. As authentic as it can possibly be, but the car was reburied back in the day, so does it really matter? You know, that car’s raced and it’s been in combat kind of thing, and to me that just makes that car even cooler and more [00:40:00] desirable than a lot of others.

Crew Chief Eric: Let’s take that back to our Testa. Yeah, use case or our Camaros and everything we’ve been talking about so far. Can you touch upon your feeling as it applies to the data when you start getting into the age old, debate preservation versus restoration? ’cause if I look at those five categories, yeah. As we move down to the driver, you know, the negatives to get applied to the value of the car.

You could also say that a preservation car lives there because it’s never been serviced. It’s been driven. It’s ori. Yeah. But a lot of people pay top dollar for a preservation class car versus a restoration concourse.

David Neyens: Well, yeah, and that was a completely opposite, flipped 20, 30 years ago, where everything had to be like jewelry.

Crew Chief Eric: What I

David Neyens: can do is, the nice thing is if I have logic, I can just change some of the scoring around a little bit to recognize the fact that a preservation class car is actually worth more Now in certain, certain circumstances, like it’s an unrestored classic Enzo. V 12 Ferrari, and if it’s presentable and it’s got a great story, [00:41:00] then there’s something to be said for that.

So I think there’s adjustments that can be made, just like when you’re adjusting comps on an appraisal,

William Ross: like with Ferrari, Jaguar, Mercedes, you know, you’re seeing the manufacturer come up with their own class, each department, and restoring these cars. How much value is that adding to it compared to going to an expert store that’s been doing it for 30, 40 years?

I mean, they’ve won Pebble Beach, they’ve won all this stuff, you know, it’s great. But how much does the manufacturer trump someone like that? Percentage wise, or is it really kind of a wash? Does it matter?

David Neyens: A classic department restoration from the factory. Versus an expert level restoration or a Conor level restoration externally by a specialist.

There’s times where I’ve seen value bumps, and you’ve seen them too, where if a known re restorer with a great reputation and a great crew hold off a concor winning restoration, or a multiple award. Restoration, I would think that that would actually enhance value. But I’ve also seen in the market where that has not enhanced value at an auction or a sale situation.

Because 30 years ago, a jewelry level restoration that [00:42:00] removed all the patina was worth more than preservation car. And now we’ve seen it flip, see in V 12 Ferrari, as you know, in matters to me, uh, and to a lot of people I’ve worked with. If a noted specialist who was still alive at the time did the, the engine rebuild, for example, that trumps a no name.

Even though they did good work, you know, sadly, I mean, there’s a name that’s built for a good reason and that’s because they’ve done good work. Then I think that helps with the value. There’s a lot of subjective factors though.

William Ross: Well, I get it. In my world, Hey, so and so did the register. That’s who you want.

Does it have it Red Book? You know, has it gone through class sheet? It’s like, okay, yeah, it’s got this redwood, but doesn’t always kind of really bugged me a little bit. That’s what everyone wants, and now it’s getting more prevalent in newer cars, so to speak. It’s creeping up into your nineties, early 2000 cars, depending on what it is model wise.

That’s the thing that’s like number one to have right off the bat if you’re selling a fry’s.

David Neyens: I think you touched on something really important here and, and that’s in auction work and catalog writing. What kind of paperwork does this car have? Is it a Carfax that only picks up history, uh, [00:43:00] starting in the, in the late nineties or early two thousands?

And the car’s 40 years old. You see a lot of things. But like the classic K book is awesome. It makes my job easier. FIA paperwork, if it’s a, a race car or homologated car. But I’ve also seen, there was a Chaparral mark, one they made, two of them. I might might have made more, I’m not sure. But it’s the one car that’s not in the, uh, Midland, Texas, uh, oil museum, Jim Hall’s place.

It’s the only one I think that’s out in the wild somewhere. And, uh. That car had an amazing amount of paperwork, and it was extremely confusing, but when you get into it, there were things that were known in the pre-internet era, and there were things that were believed to be true because someone saw a car like it somewhere.

It turns out they didn’t have them separated out properly, and histories get confused. So I actually had to take original shipping documents, copies of those, and the car went through several forms throughout its lifetime until it was restored as faithfully as possible. It was a lister, excuse me, it was a Lister Chevrolet.

Okay. Sorry. It was something from that [00:44:00] period though. And the point was there was a, a mass of paperwork and then there were letters based on what someone truly, honestly believed. They weren’t fabricating anything. It was just. This is in the eighties vintage race cars were starting to be appreciated and collected and sold, and then it really became important to get the story straight.

And so there was quite a lengthy process to get through it all. So despite the volume of paperwork, that was just the beginning. That was like put a banker’s box in front of you and then you go through that for two weeks and try not to go crazy. Then there’s other things that are far more cut and dry.

There’s, you know, the. Manufacturer statement of origin, like Alpha Romeo say, or Maserati. There’s, uh, copies of factory documents, so you know exactly how that thing left the factory. It’s, it’s funny because sometimes there’s a massive paperwork or massive documentation that is less of a help than you would think.

And then there’s others that are very much more direct. And you’ve seen that too, probably. Oh, yeah. And Don, you’ve seen that too. I mean, and you know, as a writer there’s more research, the more documents you have, but that’s always one of the biggest things is how well is the car documented? You know? Is anybody [00:45:00] still with us that I’ve interviewed people like.

There was a All American Racers, IndyCar, about seven or eight years ago that I had to do a writeup for, for an auction, and I was able to call Dan Gurney’s all American racers when he was still alive. His administrative assistant, Kathy was right there and she said, oh yeah, yeah, I’ll just go upstairs. I know where the box is, where the paperwork is for it.

And she was able to like that. And they did that once though. And then after that it was kind of like a bit more reluctance to do it. I don’t know why, but it just created work. She was willing to do it. God bless her. I mean, it was funny and she gave me like the original invoice to whoever it was that raced the car.

It was bang, bang, bang that this is it. Here’s who did any, any work to it and you know, and it didn’t get destroyed in back in the day. So

William Ross: yeah, there’s a couple of ’em. We have a gentleman that we’re all good friends with. He has the online database, storage of documents for your classic car, digitize, everything like that, that way, and then it can transfer over and how it’s encrypted or whatever.

You’re

Crew Chief Eric: talking about Julio at

David Neyens: the motor chain? Yes. So he is probably on blockchain then with it?

William Ross: Yeah,

David Neyens: an immutable record.

William Ross: Yeah. I really think that’s great because [00:46:00] then to your point, oh, it’s not lost. There it is. You know, it’s an actual, tangible asset. Absolutely. I always like what he’s doing with that.

I thought that it’s fantastic

David Neyens: and it lives on, I mean, the thing is. You have the provenance locked in as much as it can be. There it is. And it can be accessed and not messed with after that. Correct. I think that’s fabulous. You always hear about technology’s going to do this and do that, and it’s be worried.

That’s a great use case for technology. Yes. Something like that. And if it lends. Strength to the authenticity of the documents and to the vehicle itself. Well, that’s a win-win.

Crew Chief Eric: Well, on that note, let’s move into our final segment here and just sort of talk about the services that you’re providing, David.

And so you talked about putting these prospectuses together upon request to do the proof of concept to show that the math works. That’s right. To show that the algorithms work and all that kind of stuff. So basically walk us through your business process, meaning somebody say, Hey David, I listened to this podcast.

What’s the process look like? How much does it cost? Are you doing this as a service?

David Neyens: Yeah, it would be done on a fee basis, a [00:47:00] case by case basis on request. I’m still working out what kind of pricing would be appropriate. I don’t wanna undercharge, I don’t wanna overcharge, but it’s, it’s just something I’m gonna have to like, get some feedback from people and I have a sort of a target in mind.

So it’s just pretty early stages here. What I’m doing.

Don Weberg: So David, after going through all this, what’s the next step for you and Motorcopia?

David Neyens: Well, the next step is to keep forging ahead. Actually, it’s kind of exciting. I’m in the beginning of reaching out to lenders, insurers, leasing companies, industry people, and alternative investment managers, family offices.

So that’s the next step, reaching out, introducing myself, and urging people to sign up for the Motorcopia newsletter. I’ve worked really hard on the subject matter, and that’s my expertise. The online marketing is something that I have to work on and something that I need to do to roll things out better, but there’s nothing like a good old fashioned phone call or email.

So that’s the next step is just basically contacting people and urging them to sign up or gimme permission to sign them up for the Motorcopia newsletter. [00:48:00] Take a look at my reports. I’m moving to a, uh, paid model, but again, I’m working on the pricing and the levels, but I want people to see it and talk to me and if there’s, you know, suggestions or ideas about things that can be changed or updated.

Glad I got to get your feedback on the ones on the website because I was afraid that I was going too far with the information. Oh, no. And I’m glad for that. That makes me feel so much better because I don’t wanna write a book. On the other hand, you have to be able to. Defend or justify or promote what you’re saying, that there’s a thought process that goes on.

William Ross: Well, no, it was great delving into it. ’cause you know when you start, you’re going through your, you have your charts and the numbers and what I thought was great ’cause then all of a sudden, you know, I start seeing writing, I’m like gonna go into history and stuff like that, which I really don’t need. But that was just a quick little blurb.

Like a paragraph? Yeah. Maybe I go Perfect. Because I want the numbers and everything like that. I know the history of the car, I know all this stuff, da da da. For sure. What I wanna see is, okay, what’s this thing been doing previous? That’s why I, I thought it was fantastic. ’cause it it given you what you want and it’s not giving you what you don’t need and want.

It’s like, [00:49:00] Hey, this is why came. Yeah. This is what I’m supposed to be getting out of this. You have it set up great in regards to how everything’s laid out.

David Neyens: Well, thank you. I, I’m glad to get that feedback. That’s huge and, and me as a writer, I mean, I, when I’m not restricted to a word character and page count, we can all probably go right to town on it.

But is that what someone needs or wants? And, and that’s the other side of it. You want some information to take action or decide that you’re already in a good place holding or considering buying the best example of a car that you want. My whole thing is, while this is numbers driven and data driven, it’s passion driven at the root.

What I’m doing, and it’s a different approach to what I’ve been doing. So it’s, it’s actually pretty refreshing. I’m trying to get down to a, a reasonable editorial schedule where I’m putting out a newsletter every week with four or five good articles in it that I hope would give somebody either comfort or help them to say, yeah, you know what?

I do need to start considering the next set of options. Yeah, the market’s good or the market’s stable. Yeah, it’s been a great fit and I, and I’m hoping it’s something that’s unique [00:50:00] enough that my target audience will appreciate it or get proper information from, for their own life. I was just thinking I could do another content site.

I could look at doing buyer’s guides or I could do some price, uh, explorations and things like that. And then I. Let’s look at the market. The first thing was the, uh, Motorcopia market pulse index that I set up, and it’s, it’s kinda like a fear and greed kind of index just to tell you if the market is cold, medium, or hot.

It’s kinda like Goldilocks and the three Bears give you an idea of what last week’s market action was like and is the market stable? Our, our dealers filling their, their showrooms still as aggressively as before. Is there good sale activity? Is there a where the sell through is good at the auctions of last week?

Things like that. So, uh, just kind of a bit of a reading between the lines for people too.

Crew Chief Eric: Well, David, we’ve reached that part of the episode where I’d like to invite our guests to share any shout outs, promotions, thank yous, or anything else we haven’t covered thus far.

David Neyens: Two things, if anybody wants to, I have a special report on the collector car market in [00:51:00] 2025, and my forecast through the end of this year, through the end of the fourth quarter, it’s a PDF download.

I’d be happy to send that out to any of your listeners. Would like it. They reach out to me at admin@motorcopia.com and just let me know that they’d like a copy of that report. I will send the PDF over to them and hopefully start a relationship with that and add value to their, uh, car collecting or their world.

Secondly, and most importantly, I’d like to thank probably my best friend in the field who’s been my biggest supporter since I’ve been independent as a writer in 2012. And that’s Cindy Meitle of, uh, car pr USA. She is probably the og, the original gangster of. Collector, car promotion and public relations.

And if you have a worthy event, product or service in the collector car market or collector car field, I urge you wholeheartedly to reach out to Cindy at CAR PR USA and you’ll get the best support possible to get the word out.

Don Weberg: Motorcopia is a digital platform and publication founded by automotive writer and auction expert David Neyens.[00:52:00]

It caters to collector cars, enthusiasts, investors, dealers, and anyone interested in the market dynamics of classic, exotic and special interest vehicles. The focus isn’t just on car culture, it’s driven by data. Motorcopia offers tools, analysis, and reports to help people make informed decisions about buying, selling, holding, or investing in collector cars.

Crew Chief Eric: And David, I can’t thank you enough for coming on Break Fix and sharing your story with us and educating us on data-driven decision making when it comes to collector car buying, selling, and holding. It’s obvious in the way you talk, your passion, your expertise, all of it is there, and I wish you the best of luck on your latest endeavor and we will see where this goes.

Maybe the next 30, 60, 90, 12 months from now. Right? There you go. Yeah, as you say on the website. So thank you for doing this.

David Neyens: Thanks very much for having me, guys, and it’s been a pleasure. Appreciate it.

Crew Chief Eric: Yeah.

David Neyens: Good to meet you, David. Thank you. Thanks

Crew Chief Eric: again to Don and William as well.

Don Weberg: Thanks

Crew Chief Eric: for having me.

Don Weberg: All the best.

You too.[00:53:00]

Since 2007, garage Style Magazine has been the definitive source for car collectors continually delivering information about Automobilia Petroliana events and more. To learn more about the annual publication and its new website, be sure to follow them on social media at Garage Style Magazine or log onto www.garagestylemagazine.com because after all, what doesn’t belong in your garage.

ECM PROMO: For everything from Ferrari and Porsche, Lamborghini and Konig seg, visit exotic car marketplace.com. If you’re into anything with wheels and a motor, log onto to the Motoring Podcast network and check out our family of podcasts@motoringpodcast.net. This is the place to find your favorite news show. Next up a shout out to David Beatie and his team at Slot Mods who custom build some of the coolest slot car tracks in the world@slotmods.com.[00:54:00]

Let your imagination run wild. And finally, grand touring motorsports covering all aspects of auto racing and motorsports history. Check out their ezine@gtmotorsports.org. All the links for our sponsors are in the description.

Crew Chief Eric: We hope you enjoyed another awesome episode of Break Fix Podcasts, brought to you by Grand Tour Motorsports.

If you’d like to be a guest on the show or get involved, be sure to follow us on all social media platforms at Grand Touring Motorsports. And if you’d like to learn more about the content of this episode, be sure to check out the follow on article@gtmotorsports.org. We remain a commercial free and no annual fees organization through our sponsors, but also through the generous support of our fans, families, and friends through Patreon.

For as little as $2 and 50 cents a month, you can get access to more behind the scenes action, additional pit stop, minisodes and other VIP goodies, as well as keeping our team of creators. [00:55:00] Fed on their strict diet of fig Newton’s, Gumby bears, and monster. So consider signing up for Patreon today at www.patreon.com/gt motorsports.

And remember, without you, none of this would be possible.

Highlights

Skip ahead if you must… Here’s the highlights from this episode you might be most interested in and their corresponding time stamps.

- 00:00 Meet David Neyens

- 01:37 David’s Journey into Automotive Journalism

- 03:15 The Birth of Motorcopia.com

- 04:20 Understanding Motorcopia’s Unique Platform

- 06:41 Deep Dive into Car Valuation Methods & Challenges in Car Valuation

- 18:01 Worth vs. Value in Car Appraisals

- 24:08 Expanding Motorcopia’s Scope

- 28:41 Understanding Car Modifications

- 29:04 Emotional Value vs Market Value

- 33:28 Weekly Market Forecasts

- 40:06 Preservation vs Restoration Debate

- 42:50 Documenting Car History

- 46:31 Motorcopia’s Business Model

- 50:47 Final Thoughts and Promotions

Learn More

There's more to this story!

Be sure to check out the behind the scenes for this episode, filled with extras, bloopers, and other great moments not found in the final version. Become a Break/Fix VIP today by joining our Patreon.

All of our BEHIND THE SCENES (BTS) Break/Fix episodes are raw and unedited, and expressly shared with the permission and consent of our guests.

How It Works: The Motorcopia Method

Motorcopia delivers proprietary market indices – including the Market Pulse™, Forward Index™, Buy/Sell/Hold Index™, and ValueScope™ – alongside auction coverage, investment insights, and collector-vehicle analysis. With a focus on serving high-net-worth collectors, advisors, and industry professionals, combining deep cataloguing expertise with data-driven reporting to spotlight actionable trends, opportunities, and results across the global collector-car market.

David’s approach blends financial modeling with enthusiast insight. Each report scores a car out of 10 using 16 weighted data points, including but not limited to:

- Recent sales trends and auction sell-through rates

- Market liquidity and frequency of listings

- Ownership costs and service complexity

- Cultural significance and nostalgic tailwinds

- Rarity, regulatory pressures, and generational appeal

For example, the Ferrari Testarossa – a car with over 7,000 units built – was analyzed as a “solid hold” with upside potential. Using Hagerty’s 1–5 condition scale, David forecasted a median value of $160,000 for a #2 condition car, factoring in auction results, private sales, and even pop culture relevance (yes, Miami Vice matters).

One of the most compelling parts of the conversation was the distinction between “worth” and “value.” We noted, appraised value might represent a high watermark, but actual market value is shaped by momentum, liquidity, and buyer sentiment. And David’s reports aim to bridge that gap – not by replacing appraisals, but by supplementing them with actionable market intelligence. “More information is better than less,” he emphasized. “This is meant to guide you and your advisors.”

Beyond Exotics: What’s Next?

While early reports focus on blue-chip models like the Ford GT Heritage Edition and Ferrari Testarossa, David is expanding Motorcopia to include enthusiast favorites, suggestions like the IROC Camaro and even oddballs like the Taurus SHO; both of which are gaining favor in the market right now, could be part of future reports.

Why? – Because these cars have passionate followings, rich sales data, and – when unmodified and original – can be surprisingly rare. “The good cars are so rare in that space,” David said. “It’s like Fox-body Mustangs.”

David was candid about AI’s potential and pitfalls, as part of an expansion of Motorcopia’s algorithm. “It’s a tool. It doesn’t replace what people are already doing,” he said. While AI can assist with data processing, it demands diligence and human oversight – especially in a field as emotionally charged and nuanced as collector cars.

Motorcopia isn’t just another valuation tool – it’s a strategic resource for anyone serious about understanding the collector car market. Whether you’re buying, selling, or holding, David Neyens is offering something rare: clarity in a world driven by passion.

As the collector car space continues to broaden – embracing Japanese classics, AMG Mercedes, and more – Motorcopia.com is poised to become an indispensable guide for the next generation of petrolhead investors.